"Supreme Chancellor and Glorious Leader SaveTheIntegras" (jegoingout)

"Supreme Chancellor and Glorious Leader SaveTheIntegras" (jegoingout)

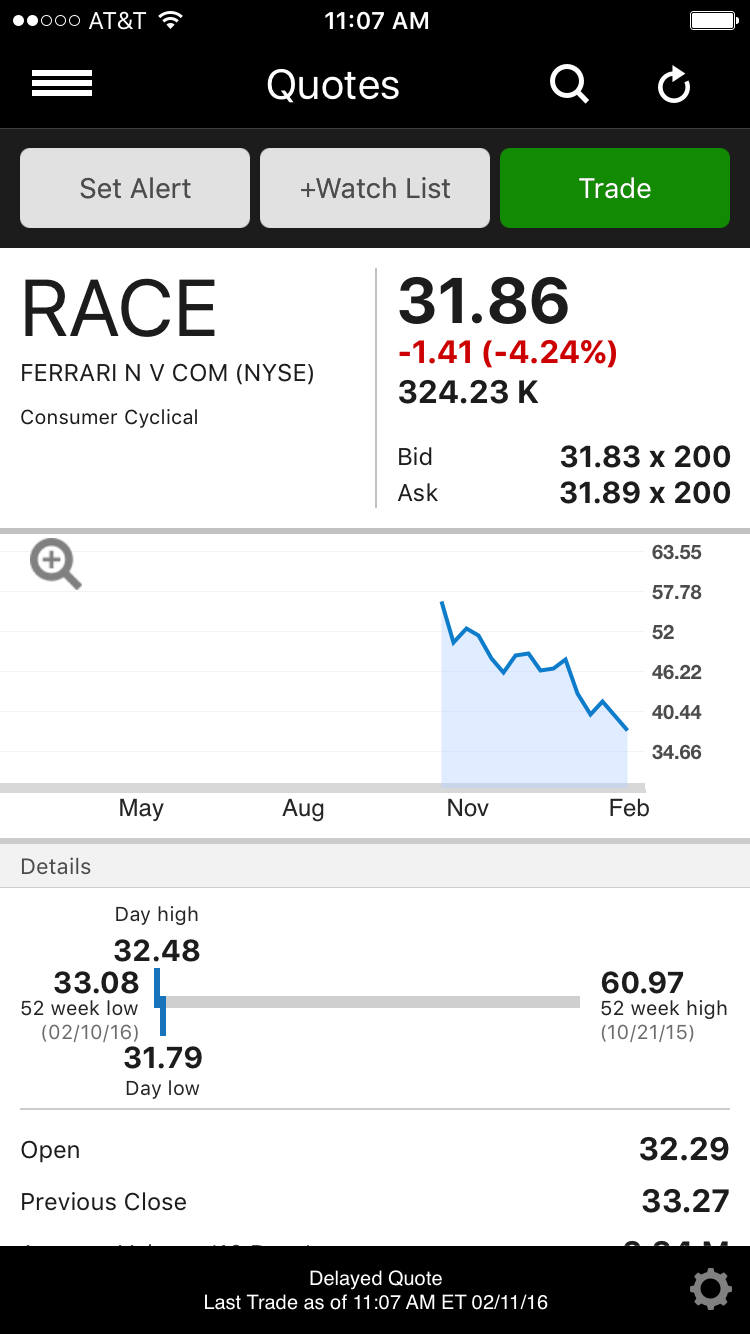

02/11/2016 at 11:44 ē Filed to: Ferrari shares are a flaming pile of poop

2

2

9

9

"Supreme Chancellor and Glorious Leader SaveTheIntegras" (jegoingout)

"Supreme Chancellor and Glorious Leader SaveTheIntegras" (jegoingout)

02/11/2016 at 11:44 ē Filed to: Ferrari shares are a flaming pile of poop |  2 2

|  9 9 |

adamftw

> Supreme Chancellor and Glorious Leader SaveTheIntegras

adamftw

> Supreme Chancellor and Glorious Leader SaveTheIntegras

02/11/2016 at 11:47 |

|

Seems like a good time to buy Ferrari stocks? Maybe?

Supreme Chancellor and Glorious Leader SaveTheIntegras

> adamftw

Supreme Chancellor and Glorious Leader SaveTheIntegras

> adamftw

02/11/2016 at 11:48 |

|

Theyíre still trending downwards, I feel at even 32.10, itís going to go further down

R Saldana [|Oo|======|oO|] - BTC/ETH/LTC Prophet

> Supreme Chancellor and Glorious Leader SaveTheIntegras

R Saldana [|Oo|======|oO|] - BTC/ETH/LTC Prophet

> Supreme Chancellor and Glorious Leader SaveTheIntegras

02/11/2016 at 11:55 |

|

If they podium or win in Australia in a couple months I bet it jumps 15+ points

Aaron M - MasoFiST

> Supreme Chancellor and Glorious Leader SaveTheIntegras

Aaron M - MasoFiST

> Supreme Chancellor and Glorious Leader SaveTheIntegras

02/11/2016 at 12:01 |

|

The entire market is in a downturn right now, so itís not a good time to be looking for upside from anyone. That said, now is the time to buy, especially if you can hold for a while.

Supreme Chancellor and Glorious Leader SaveTheIntegras

> Aaron M - MasoFiST

Supreme Chancellor and Glorious Leader SaveTheIntegras

> Aaron M - MasoFiST

02/11/2016 at 12:03 |

|

Noticed that, everyone on my watchlist is trending straight down...excluding Tesla which I expect to be negative by tomorrow

Aaron M - MasoFiST

> Supreme Chancellor and Glorious Leader SaveTheIntegras

Aaron M - MasoFiST

> Supreme Chancellor and Glorious Leader SaveTheIntegras

02/11/2016 at 12:08 |

|

Yeah, SeekingAlpha seems to be rallying around a Tesla short, but who knows.

My non-retirement portfolio is all index funds, and dividend-maximizing ones at that. One one hand, Iím handily outperforming the market now; on the other hand, outperforming the market is being down 5.5% year-to-date while the S&P is down 9.5%.

Ash78, voting early and often

> Supreme Chancellor and Glorious Leader SaveTheIntegras

Ash78, voting early and often

> Supreme Chancellor and Glorious Leader SaveTheIntegras

02/11/2016 at 12:12 |

|

Iím down 15% this year so far. Some of my individual stocks are down 30%. There is no winning right now, just waiting to call the bottom.

StingrayJake

> Supreme Chancellor and Glorious Leader SaveTheIntegras

StingrayJake

> Supreme Chancellor and Glorious Leader SaveTheIntegras

02/11/2016 at 12:20 |

|

Donít worry. It hasnít spontaneously combusted yet. Thereís plenty of time for it to hit rock bottom, be restored, and sold at auction for a cool million.

swaptastic

> Supreme Chancellor and Glorious Leader SaveTheIntegras

swaptastic

> Supreme Chancellor and Glorious Leader SaveTheIntegras

02/11/2016 at 16:24 |

|

It is tough to say. Stocks become good investments because people either believe there is growth or they pay dividends. I donít believe they pay a dividend so it comes down to simply do you feel they are going to sell a lot more Ferraris in 5-10 years?

Another thing I might take into consideration is how the company leadership view profit. Now that they are a publicly traded company they will be encouraged to seek out profit constantly. Otherwise institutional investors will get frustrated and stop investing in the company.

Also included to compare P/E ratio (currently RACE 14.99)

!!! UNKNOWN CONTENT TYPE !!!